CA SOI Filing Guide 2026: How To File California Statement of Information Online

2026-01-15

If you searched for CA SOI, California SOI, or how to file the Statement of Information, you are in the right place.

This guide shows you exactly how to file the California Statement of Information (SOI) online, with simple steps, screenshots, and key FAQs. It also covers who must file, deadlines, fees, penalties, and official links.

Last updated: Jan 2026

Quick answer: how CA SOI filing works

Short version:

- The California SOI is a basic info filing with the Secretary of State.

- Most corporations file every year. Most LLCs and nonprofits file every two years.

- You file online through the bizfile portal and pay a small fee.

- If you miss it, the state can assess a penalty and may suspend your entity.

The quick reference table below has the main rules in one place.

Quick Reference (What, Who, When, How Much)

| Topic | Details |

|---|---|

| What? | The SOI is an informational filing sent to the California Secretary of State (SOS) listing Registered Agent, officers/directors or managers/members, addresses, and business activity. |

| Who Must File? | Domestic & foreign corporations (annual) and LLCs/nonprofits (biennial). |

| Initial Filing Date | Within 90 days of registering. |

| Following Filing Dates | Corporations file annually during your registration month. LLCs/Nonprofits file biennially. |

| Filing portal | bizfile Online (California SOS). |

| Typical fee | Corporations: $25; LLCs: $20. |

| Late penalty | $250 may apply for failure to file on time. |

Get guidance tailored to your business

What do you need to file

Corporations (Stock/Foreign/Co-ops):

- Legal name, entity number, formation state

- Business and mailing addresses (and CA office, if applicable)

- Registered Agent (name/registered agent service + address)

- Officers & Directors (names/addresses) — CEO, CFO, Secretary required

- Business activity description

LLCs (Domestic/Foreign):

- Legal name, entity number

- Business and mailing addresses

- Registered Agent

- Managers/Members (names/addresses) and CEO (if elected)

- Business activity description

Forms & instructions (official):

Step-by-Step: How to File Your SOI Online

Step 1 — Open the SOS portal and sign up (if needed)

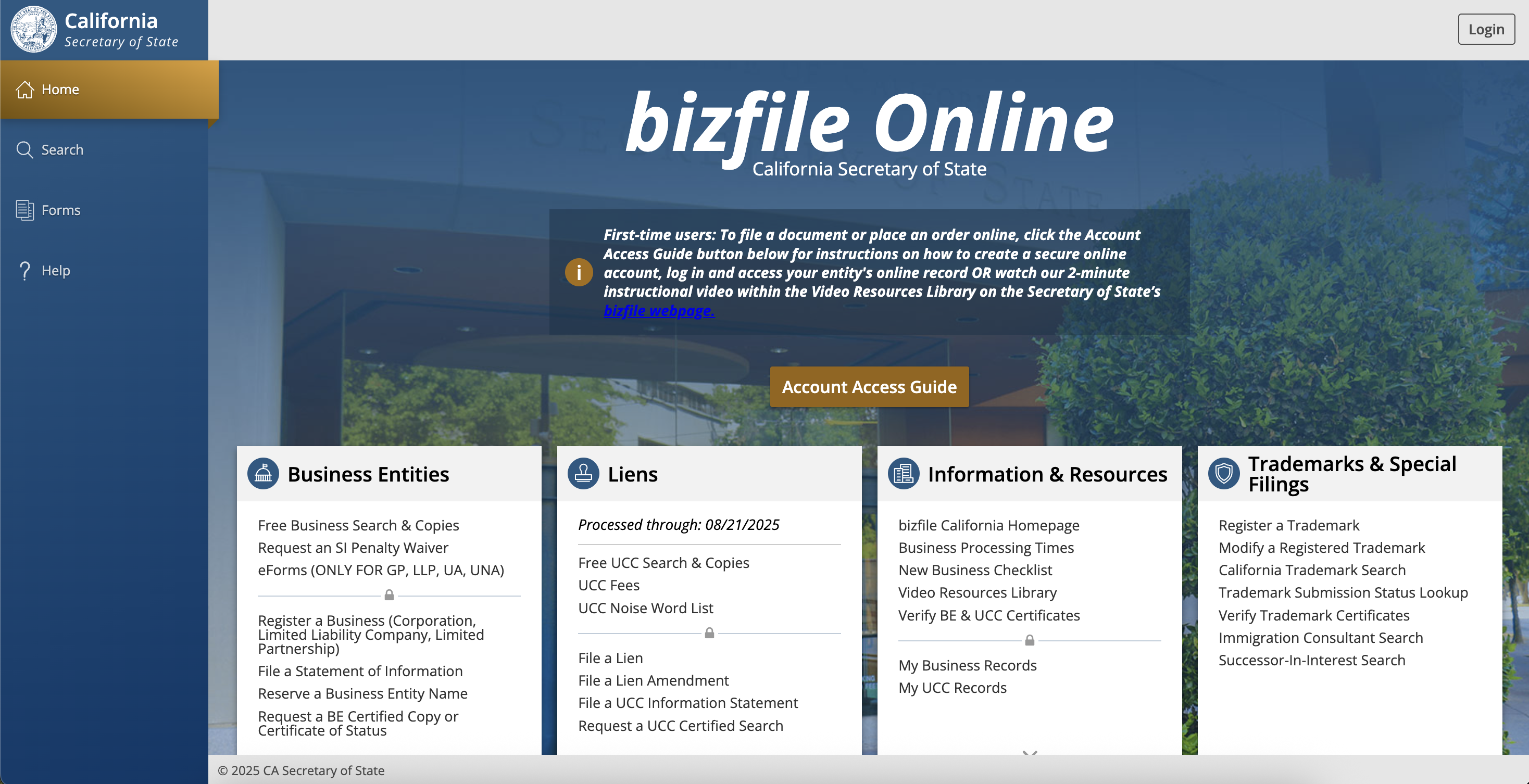

Go to bizfileonline.sos.ca.gov and select Log In at the top right.

- If you don’t already have an account, sign up for one.

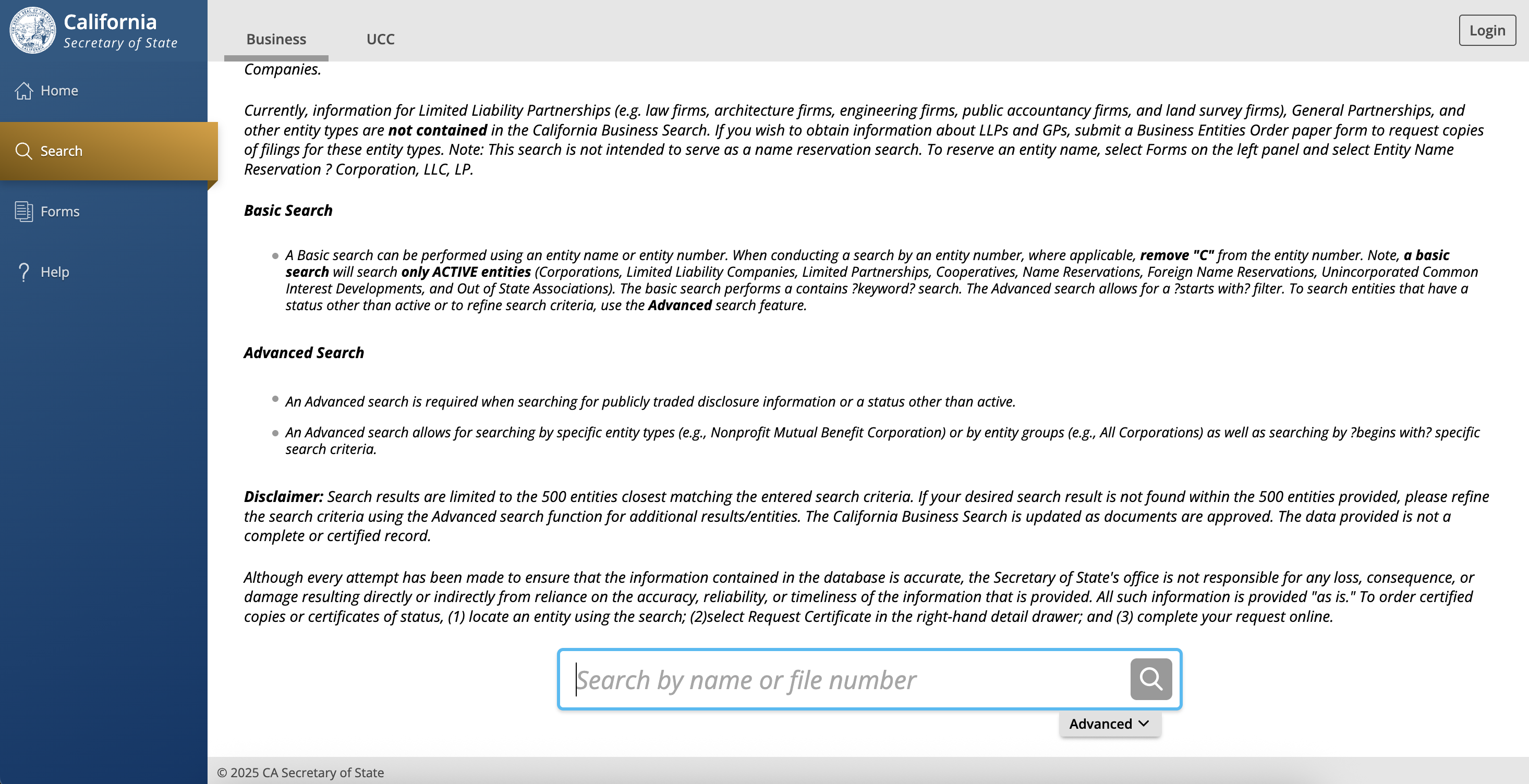

Step 2 — Use the left sidebar to open Search and search for your business

On the left side of the page, click Search, and scroll down. At the bottom of the page, search for your business by name or file number

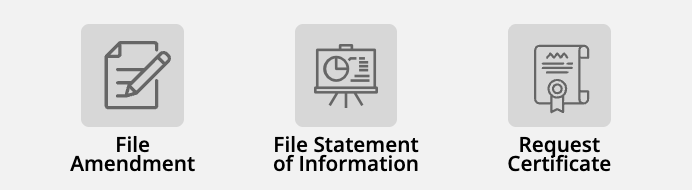

Step 3 — Open your entity & start the SOI

Select your entity. On the right side of the page, click File Statement of Information.

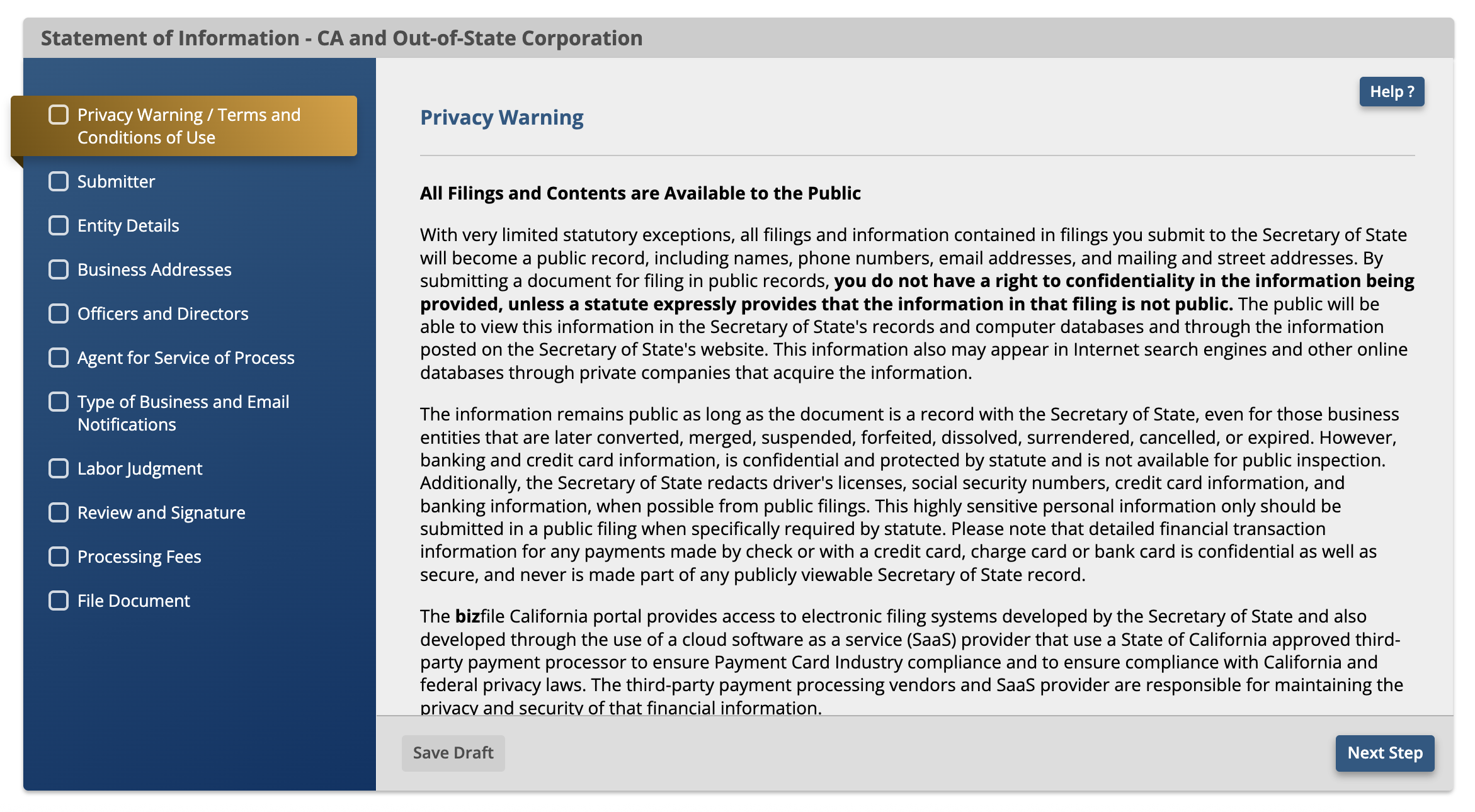

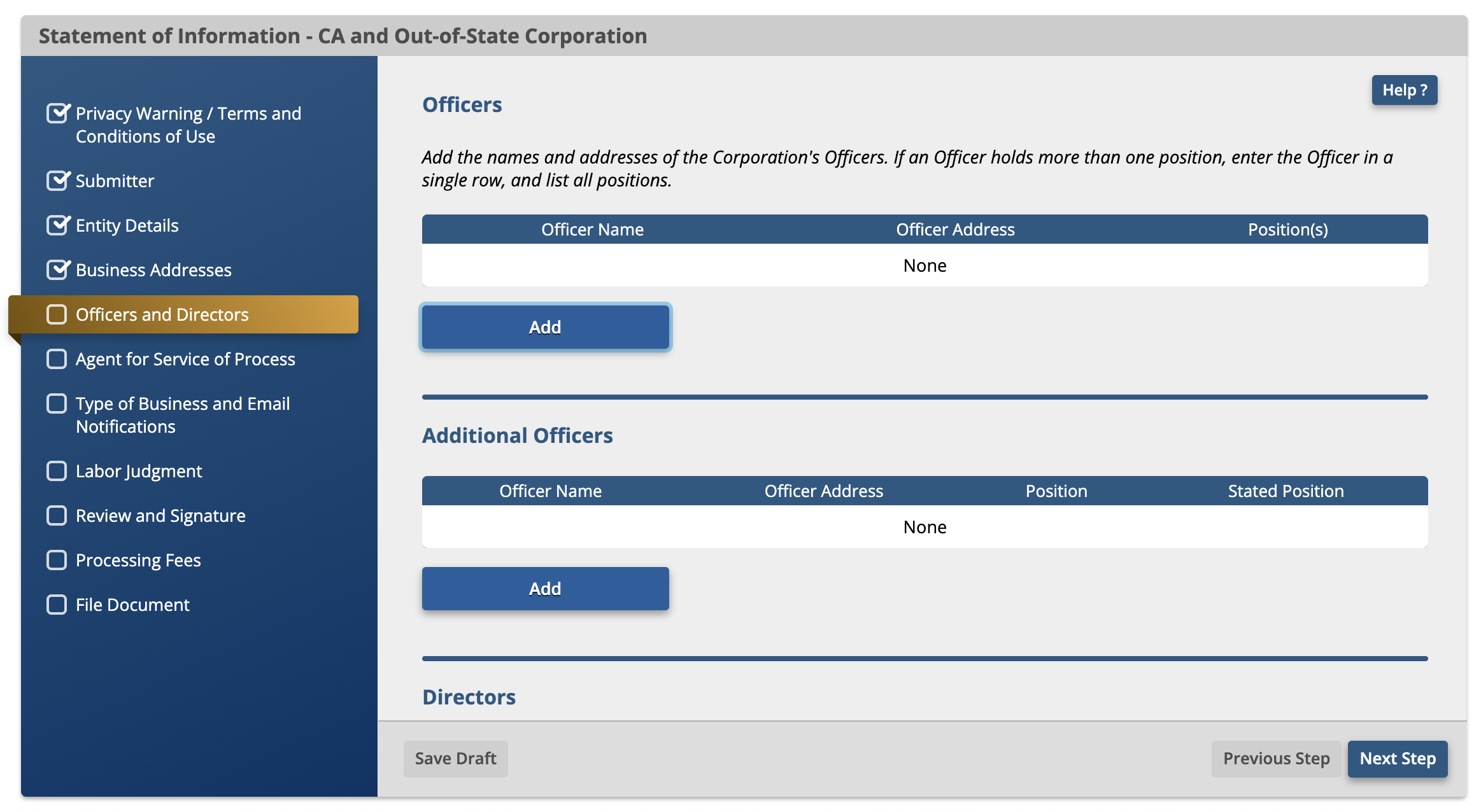

Step 4 — Complete the SOI form

Fill in required fields.

Common issue: You must include CEO, CFO, and Secretary.

- If you don’t have all roles formally assigned, complete them to the best of your ability (e.g., the CEO may also serve as CFO if no separate CFO exists).

Step 5 — Pay & save confirmations

Submit payment, then download/save the receipt and filed SOI confirmation for your records.

Fees, Penalties, and Waivers

- Filing fees (typical): Corporations: $25, LLC: $20.

- Late penalty: $250 for failure to file on time (assessed via Franchise Tax Board after SOS delinquency).

- No-change filings: You must still file even if nothing changed.

- Penalty relief: You can request a waiver if you have reasonable cause (see SOS guidance/FTB).

Official references:

Suspensions & How to Reinstate

Your entity can be suspended/forfeited by:

- Secretary of State (SOS) — for SOI failures or certain obligations (e.g., Victims of Corporate Fraud Compensation Fund).

- Franchise Tax Board (FTB) — for unpaid taxes, penalties, or missing tax filings.

Reinstatement (typical flow):

- File the missing SOI via bizfile Online.

- Resolve SOS-specific issues (if any).

- If FTB-suspended, follow FTB “Revive my business” steps.

Official Resources

Learn more about Afternoon

Seamlessly integrated financial stack, that handles your bookkeeping, taxes, and compliance.